refinance closing costs transfer taxes

Mortgage refinance closing costs typically range from 2 to 6 of your loan amount depending on your loan size. You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes.

Ad Shortening your term could save you money over the life of your loan.

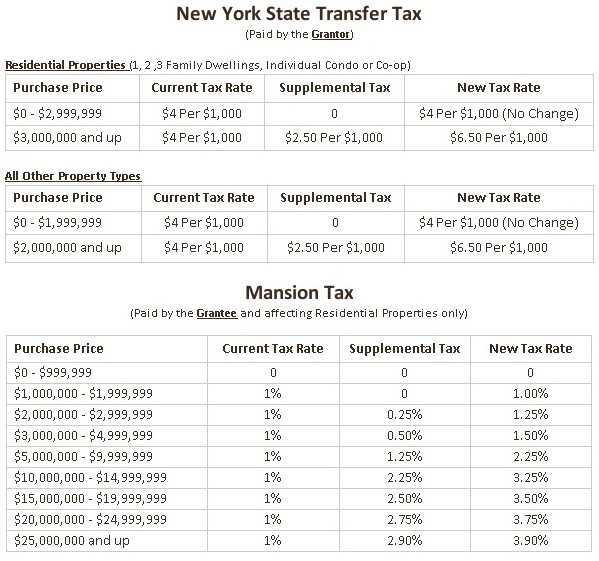

. When the same owner s retain the property and simply. New York 2000. In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due.

Understanding Refinance Mortgage Tax Deductions in 2022. Ad Get Your Custom Mortgage Rate Quote Today. Comparisons Trusted by 45000000.

National average closing costs for a single. Ad 2020s Trusted Online Mortgage Reviews. 2400 12 680 034 None.

As you prepare to set aside money for your refinance closing. But they can run between 2 and 6 of the total amount borrowed. Note that transfer tax rates are often described in terms of the amount of tax charged per 500.

Our Trusted Reviews Help You Make A More Informed Refi Decision. Youll typically pay mortgage refinance closing costs equal to between 2 and 6 of your loan amount depending on the loan size. Average refinancing closing costs are 5000 according to Freddie Mac.

That means youd likely pay. For example if you spent 15000 on closing costs for a 15-year refinance youd deduct 1000 a year until your loan matures. Total transfer tax.

1 day agoBalance transfer. North Carolina 1000. Ad Explore your refinance options compare low cost refinance rates today.

State Transfer Tax is 05 of transaction amount for all counties. Paying property taxes and other costs when refinancing. Most people who buy a home or refinance an existing mortgage pay closing costs.

National average closing costs for a refinance are 5749 including taxes. You closing costs are not tax deductible if they are fees. The national average closing costs for a single-family property refinance in 2021 excluding any type of recordation or other specialty tax was 2375.

You cant deduct more than 10000 per year 5000 if married filing separately in property taxes sales taxes and state and local income taxescombined. By Bryan Dornan bryandornan. Remember that tax laws can change on a year-to.

Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing. While that was is up 88. For example in Michigan.

State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower pays on the difference of.

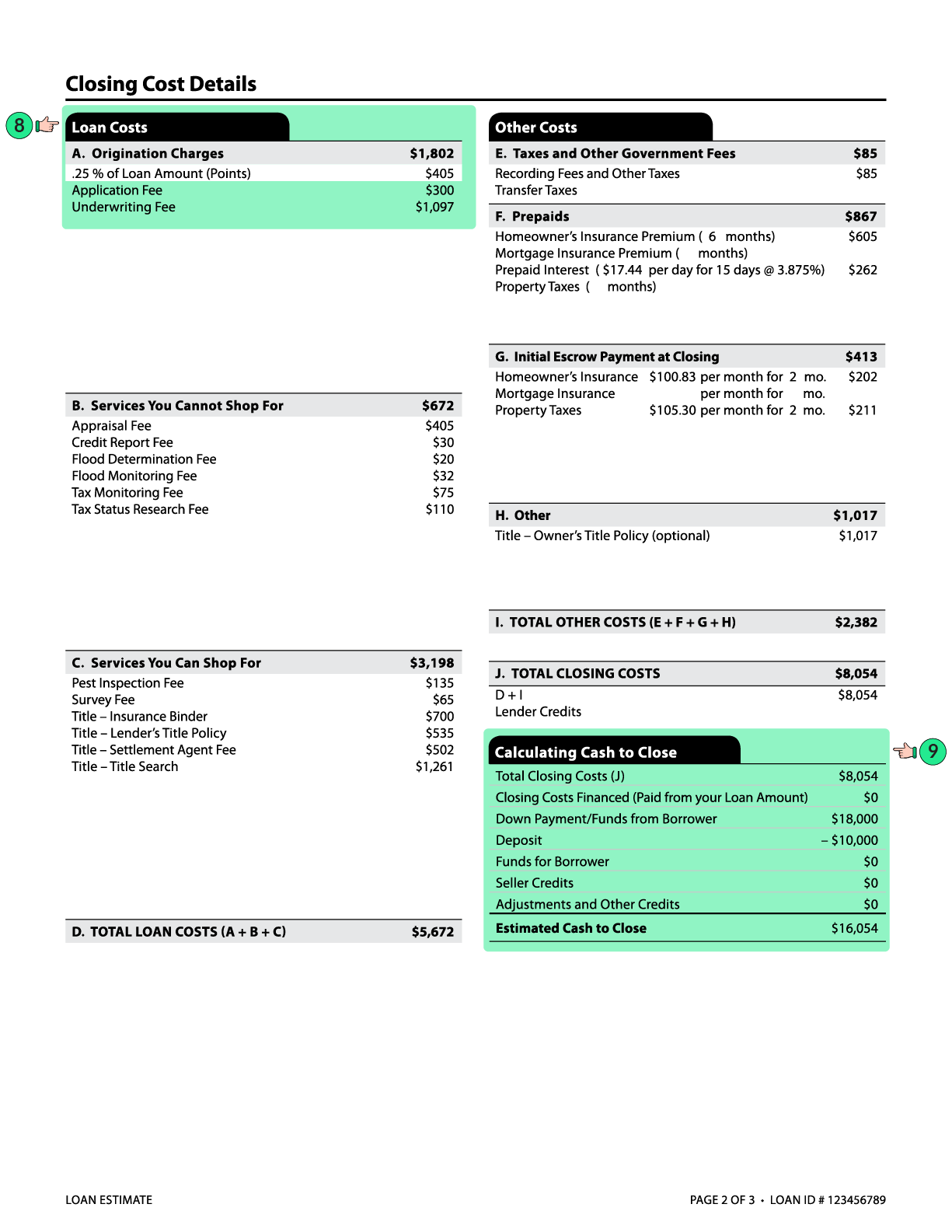

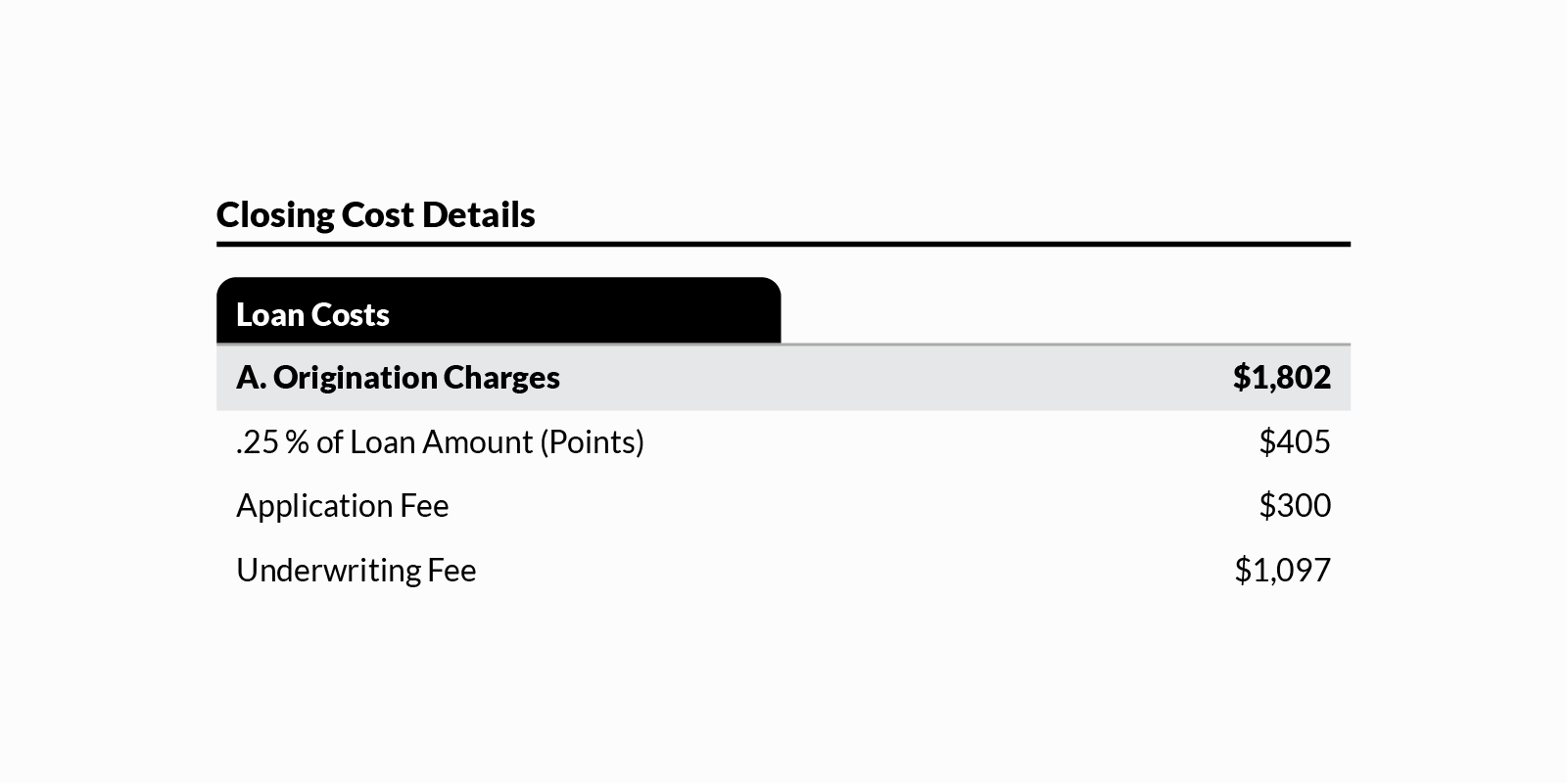

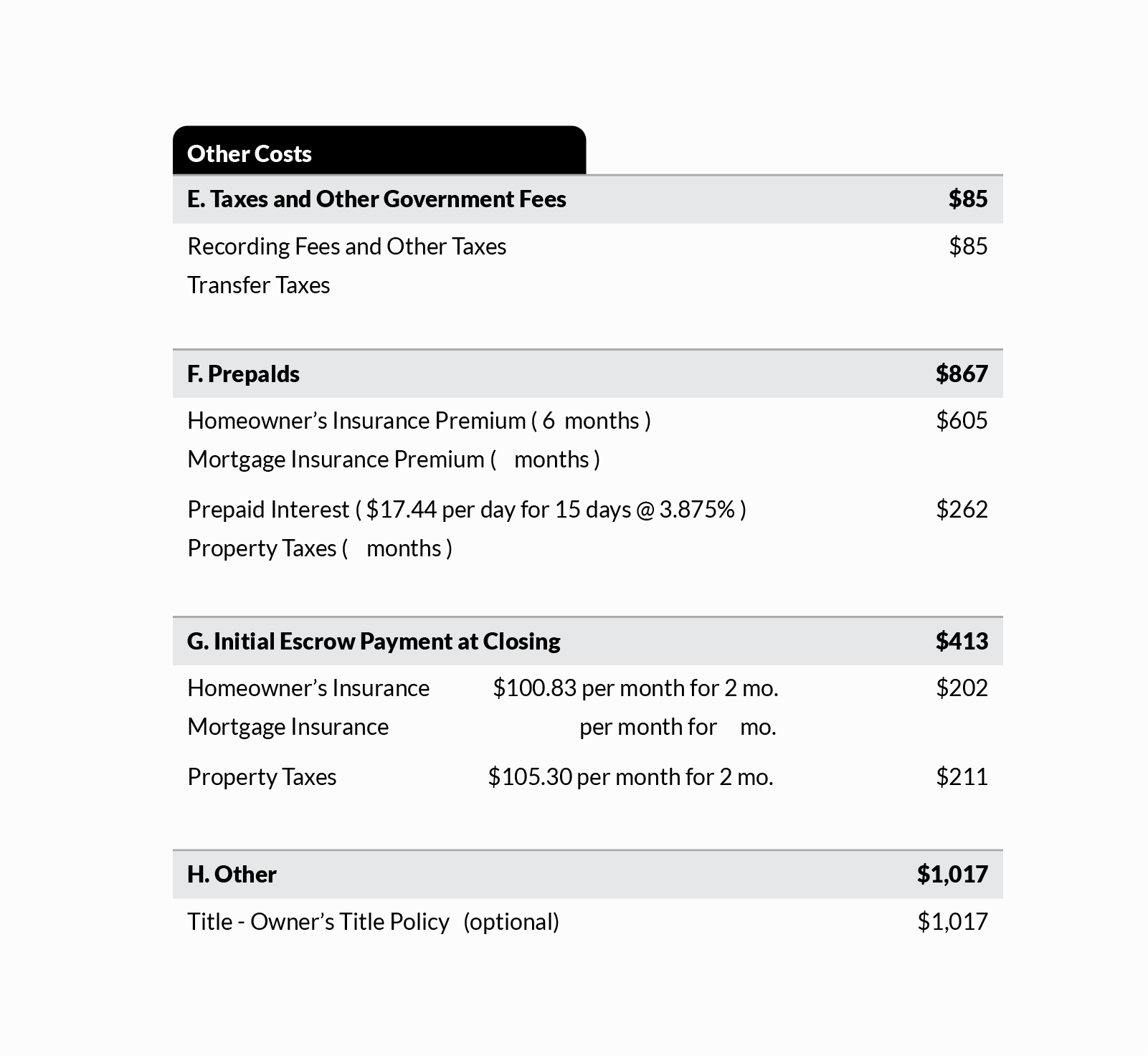

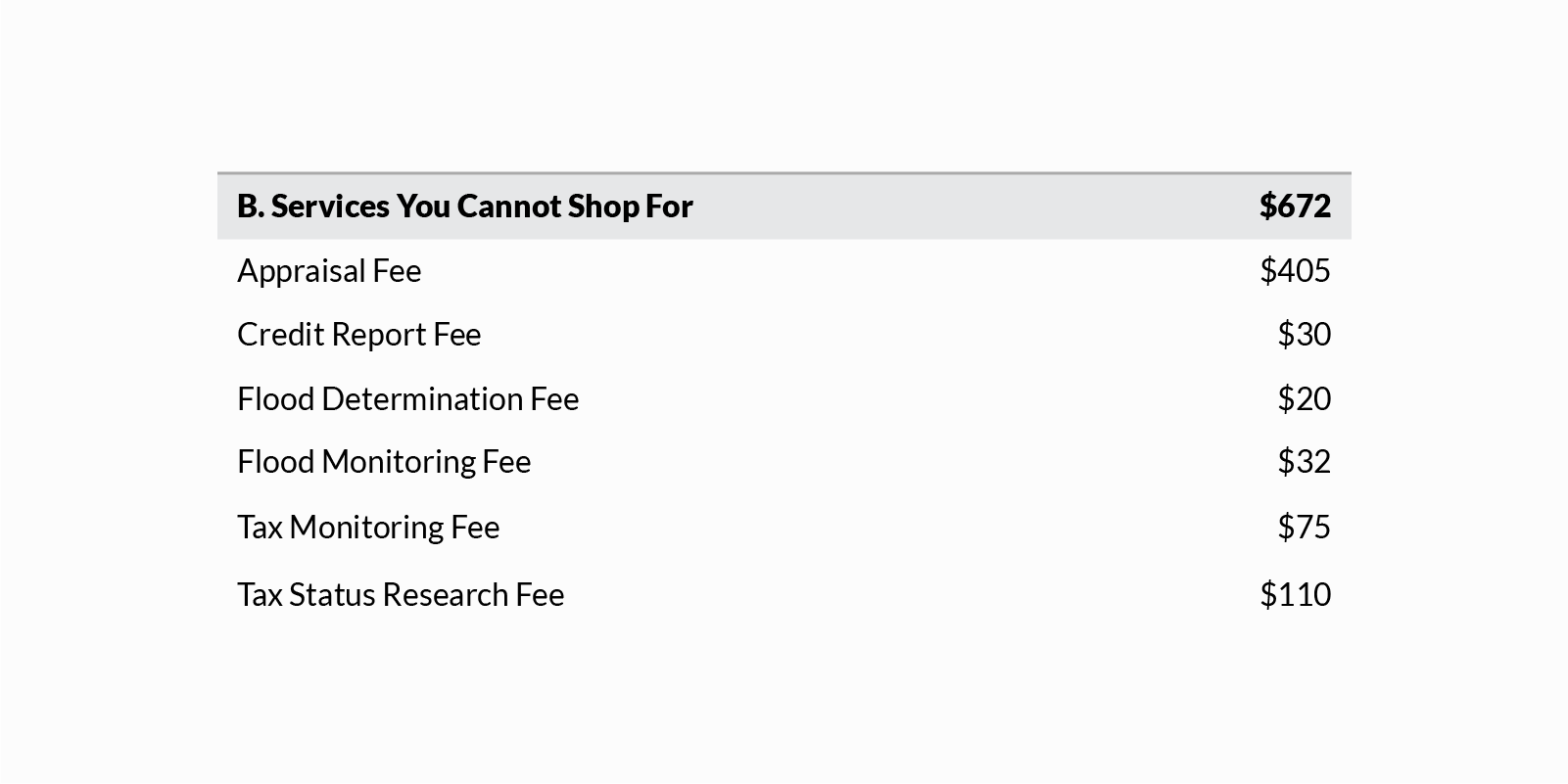

What Is A Loan Estimate How To Read And What To Look For

Understanding Mortgage Closing Costs Lendingtree

Closing Costs When Paying All Cash For A Home Financial Samurai

Understanding Mortgage Closing Costs Lendingtree

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Real Property Transfer Tax Increase The Judicial Title Insurance Agency Llc

What Are Real Estate Transfer Taxes Forbes Advisor

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Understanding Mortgage Closing Costs Lendingtree

The Complete Guide To Closing Costs In Nyc Hauseit

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Understanding Mortgage Closing Costs Lendingtree

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit